Gold has long been one of the most preferred forms of investment in India. From jewellery and coins to bars and digital gold, Indians hold gold both for cultural reasons and as a financial asset. However, when it comes to Income Tax Return (ITR) filing, many people are unsure how to declare their gold holdings. Proper reporting is essential to remain compliant with the Income Tax Act, 1961, and avoid legal complications.

This guide explains how to report gold in your ITR, applicable exemptions, and tax implications for Indian taxpayers.

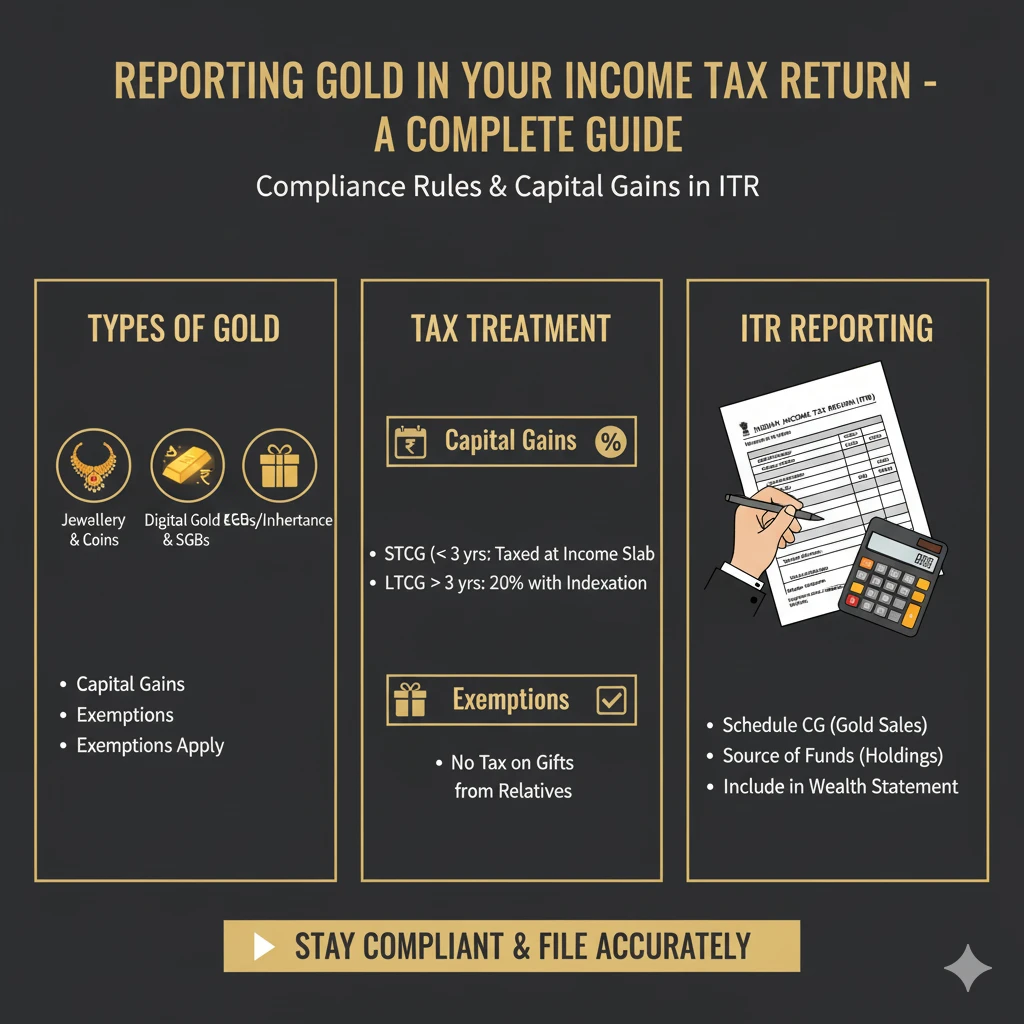

1. Types of Gold That Must Be Reported

Gold can be held in various forms, and each may have different reporting requirements:

- Physical Gold Jewellery: Necklaces, bangles, rings, and other ornaments.

- Gold Coins and Bars: Purchased from banks or jewellers.

- Digital Gold: Held in demat accounts or online platforms.

- Sovereign Gold Bonds (SGBs): Issued by the Government of India.

While jewellery and coins are considered personal assets, SGBs and digital gold are treated as financial investments, and their reporting is slightly different.

2. Reporting Gold in ITR

A. Personal Assets – Jewellery, Coins, and Bars

If you own gold jewellery or coins, you generally do not need to report it every year in your ITR unless:

- You sell gold during the financial year and make a profit.

- The total value of your assets is required under Schedule AL (Assets and Liabilities) if your income exceeds ₹50 lakh or under scrutiny cases.

Key Points:

- The cost of acquisition is important for capital gains calculation. Keep bills, invoices, and gift deeds safe.

- For inherited gold, the cost of acquisition is considered the fair market value (FMV) as of April 1, 2001, for long-term capital gains purposes.

B. Digital Gold

Digital gold is considered a financial investment, similar to buying physical gold. Reporting rules:

- Record the purchase price, quantity, and date of purchase.

- Upon selling, calculate capital gains:

- Short-term: If sold within 3 years, gains are added to your total income and taxed as per slab rate.

- Long-term: If sold after 3 years, taxed at 20% with indexation.

C. Sovereign Gold Bonds (SGBs)

SGBs issued by the RBI are treated as government securities:

- Interest earned on SGBs is taxable as income from other sources.

- Capital gains on redemption after maturity are exempt from tax.

- If sold on the secondary market before maturity, gains are taxed according to short-term or long-term capital gains rules.

3. Capital Gains Tax on Gold

When you sell gold, capital gains tax applies based on the holding period:

| Holding Period | Tax Rate | Notes |

|---|---|---|

| Less than 3 years | Added to income, taxed as per slab | Short-term capital gains |

| More than 3 years | 20% with indexation | Long-term capital gains, FMV considered for inherited gold |

Example:

- You bought 10 grams of 22K gold for ₹5 lakh.

- Sold 4 years later for ₹7 lakh.

- Indexed cost after considering inflation = ₹5.5 lakh

- Taxable long-term capital gain = ₹7 lakh – ₹5.5 lakh = ₹1.5 lakh

4. Gold Received as Gift

Gold received as a gift has its own rules:

- From relatives: Fully exempt from income tax.

- From non-relatives: Exempt only if the total value of gifts in a financial year is below ₹50,000. Above this, the fair market value is taxable under Income from Other Sources.

Example: Receiving ₹2 lakh worth of gold from a friend will be taxable. Receiving the same from your father is fully exempt.

5. GST and Documentation

While GST is applicable on gold purchases, it does not need to be reported in ITR separately. However, you should retain:

- Bills and invoices for all gold purchases

- Receipts for gifts received

- Digital gold or SGB statements

These documents help during capital gains calculation or in case of Income Tax scrutiny.

6. Practical Tips for Tax Compliance

- Maintain Accurate Records: Bills, invoices, and gift deeds are crucial for both personal and inherited gold.

- Declare Sale of Gold: If you sell gold, report capital gains accurately in your ITR.

- Keep Digital Statements: For SGBs and digital gold, retain online statements as proof.

- Plan Gifts Wisely: Gifts from relatives are tax-free, but gifts from non-relatives above ₹50,000 attract tax.

- Use Schedule AL if Required: For high-net-worth individuals, disclose gold as an asset in Schedule AL.

Expert Tax Guidance for Gold Transactions

Get professional advice on gold tax reporting and compliance. Contact AuFluence for accurate valuation and tax planning.

Get Tax ConsultationConclusion

Gold remains a trusted investment and cultural asset in India. While owning gold jewellery or coins does not trigger mandatory reporting in most cases, selling or receiving gold as a gift has clear tax implications. Digital gold and SGBs are treated as financial instruments, and capital gains must be calculated carefully.

By maintaining proper documentation and understanding capital gains, exemptions, and reporting rules, taxpayers can enjoy gold as an asset without facing any compliance issues. Proper planning ensures that gold continues to shine both culturally and financially.